📈 Market Decoder

I decode fresh, comprehensive real estate market data to identify emerging trends so buyers, sellers and investors can make informed decisions. Buying or selling in the District of Columbia? Start here.

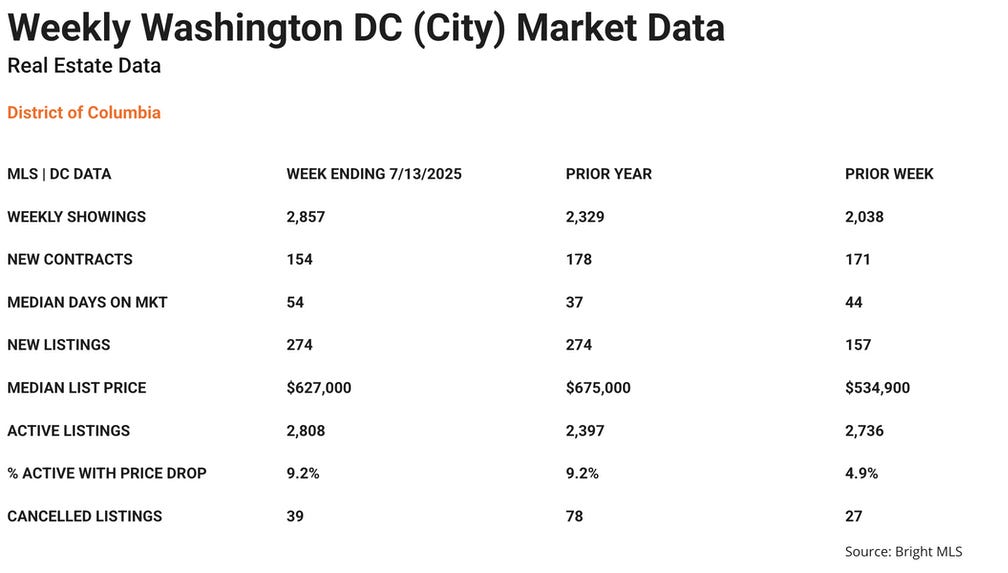

The Week Following A Holiday Is Transitional

The Fourth of July holiday had an impact on last week’s numbers. As expected, activity increased. Buyers came out to see what they’d missed, raising showing numbers week-over-week and year-over-year. Will this result in higher new contract numbers next week? Very possibly. The second week of July also saw the number of new contracts lagging WoW and YoY by double digits, reflecting the lack of activity during week one. The year-over-year number is likely indicative of increased holiday travel in 2025. A record number of Americans traveled for the 4th of July week this year compared to 2024. New listings higher last week (also not a surprise) and flat YoY. Median list price recovered from the holiday dip, but is still approximately $50k lower than it was last year. Price drops for Active listings hiked, reflecting some urgency by sellers to complete a sale before the August real estate drought sets in. The number of cancelled listings also rose WoW but fell well below the YoY metric.

Here are last week’s numbers:

Once posted, this week's numbers will provide a more accurate picture of the market, without the holiday skew.

What To Expect Next Week

Fewer new listings are expected to enter the market the third week of July. During the final two weeks of the month, listing agents will push hard to sell existing listings, so I’m predicting additional price drops, and lots of open houses resulting in increased showing numbers. The number of new contracts should rise.

August is historically a low-activity month in the District as legislators head to their home states and residents take vacations. Agents often pull listings from the market in August and plan autumn relisting strategies.

📬 For a comprehensive rundown on Washington DC real estate market data, and a breakdown on what’s selling, what’s sitting, and where leverage is shifting,

Subscribe free—or reach out at realestateinthedistrict.com for a consult built around your needs.