U.S. Housing: The Real Outlook for the Next Six Months (Aug 2025 – Feb 2026)

The wild seller’s market is fading—what’s next isn’t a crash, but it’s no boom, either.

If you’re watching the headlines or scrolling through a Compass Collection, you already know the U.S. housing market isn’t what it was two years ago. Here’s what’s different now, and why it matters for anyone thinking about buying, selling, or just staying put.

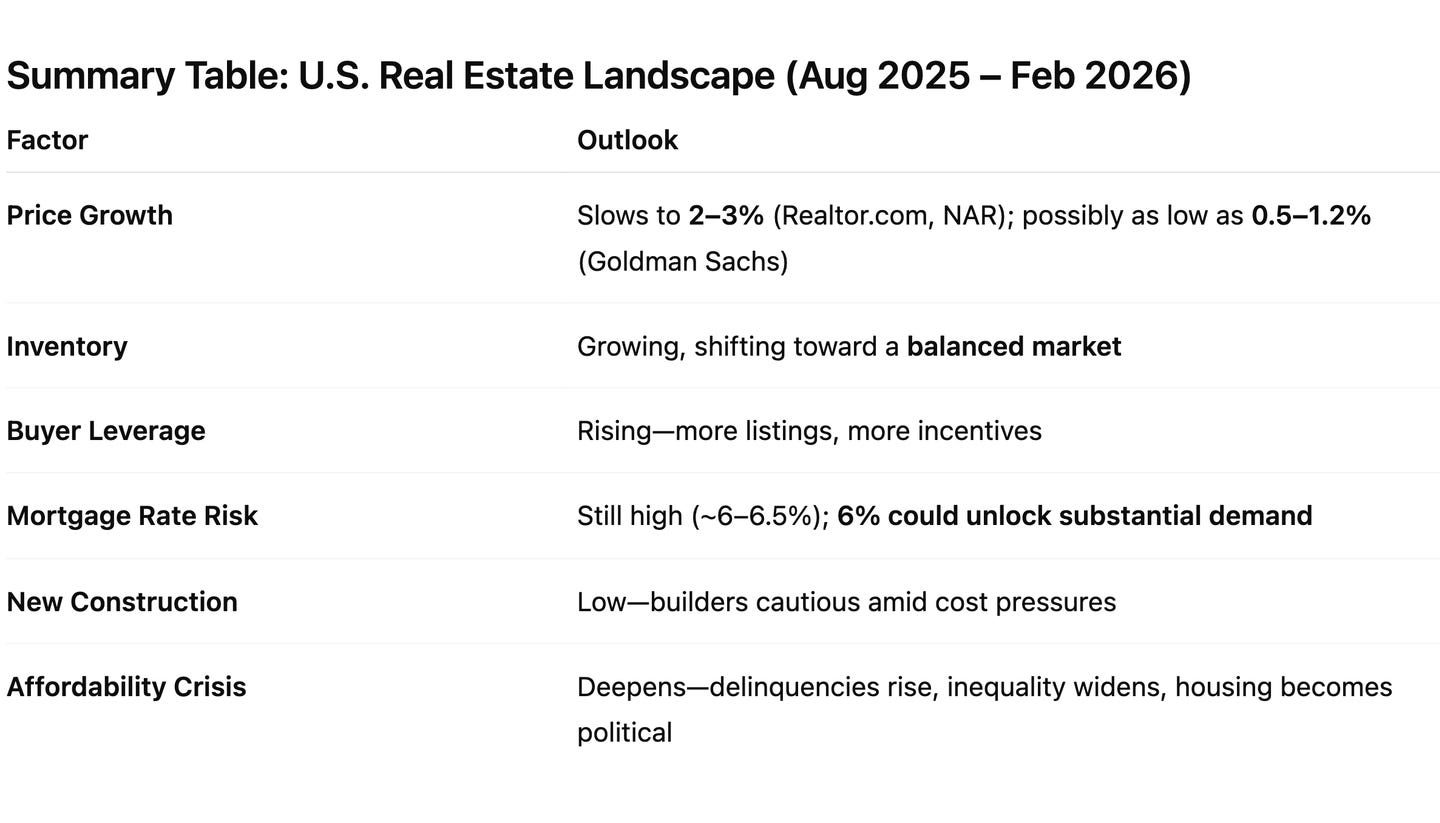

Home Prices: Rising, But Losing Steam

Let’s start with the big question: Are home prices still rising? The short answer is yes, but the days of double-digit gains are evaporating.

Realtor.com calls for a 2.5% rise in existing home prices in 2025

The National Association of Realtors (NAR) is ever-bullish at 3%

Goldman Sachs (via Moody’s) dialed back expectations to just 0.5% for 2025, with a slight bump to 1.2% in 2026

What were the most influential factors in the market slowdown during the first half of the year? Elevated mortgage rates, increased inventory and consumer caution.

Prediction: Prices will likely keep inching up—just not fast enough to outpace rising inflation or make you significantly wealthier overnight.

Inventory: The Shift Toward Balance

The real change isn’t price, that’s still a sticking point for some buyers, it’s power. For the first time in years (or a decade and a half in D.C.), home buyers are getting a little more say because listing volume is up.

As of August 2025, active U.S. home listings have climbed to over 1.1 million, the highest level in more than five years, per Realtor.com

National active listings have increased by 25% from July 2024 to July 2025, tipping more leverage toward buyers, ResiClub Analytics reports

In the first quarter of 2025, about 44.4% of home sales involved some kind of seller concession—such as rate buydowns, credits, or help with closing costs, according to Business Insider. Some of the credits are likely attributable to buyer broker compensation due to the 2024 NAR settlement terms.

Upshot: Sellers have to try harder. If you’re buying, expect more wiggle room—whether that’s price, timing, or extras thrown in—and opt for the perk that makes the rate worth it. In Washington DC, sometimes that simply means getting the house you want without engaging in a price-inflating bidding war.

Mortgage Rates & Affordability: The Waiting Game

Rates are still high by 2010-2022 standards, but rate pressure is slowly easing.

Most experts see 30-year rates holding near 6.4% through year-end

There’s a “psychological tipping point” around 6%—if rates dip below, expect a stampede of pent-up home buyers suddenly jumping into the market, creating competition that will put upward pressure on prices.

Upshot: Affordability is still tough, but rates aren’t expected to crater, so the smart play is to find the best available program and buy before the rush. Remember, the price you pay for a home is set in concrete, but your mortgage rate can be updated. Assess the risks. Consult experts. Be reasonable, and act when it’s advantageous.

Builders & New Construction: Still Cautious

Don’t count on a wave of new homes to fix things fast.

Home starts are down for six consecutive months, year over year

Builders remain nervous due to high costs, need for extra incentives, and not garnering enough buyers to absorb big new developments

Upshot: Inventory gains are coming from existing homes (resales), not new builds. The shortage isn’t going away overnight.

The Pressure Cooker: Affordability, Stress, and Policy

Here’s what’s fueling the tension and headlines:

A deep supply gap: The U.S. is still short by an estimated 3.5 to 4 million homes, according to multiple analysts, leaving buyers scrambling for options even as listings rise, per MarketWatch

Sellers are “locked in” by cheap mortgages: Nearly 80% of homeowners with mortgages are sitting on rates below 4%, making them reluctant to sell and face today’s higher rates

First-time buyers are squeezed hardest: Home prices and monthly payments are both near record highs, while wage growth has slowed. Student loan payments have resumed, and FHA mortgage delinquencies are up—signs that many younger and lower-income households are feeling the pinch (MarketWatch)

Institutional buyers are crowding out some traditional buyers: Large investors now own roughly 30% of new single-family rental homes nationwide, intensifying competition and driving up prices in some markets, according to a report by Financial Times

Housing is a political flashpoint: With affordability at its worst in decades and homeownership rates stagnating, expect housing policy to remain a top debate as policymakers scramble to address both soaring rents and stubborn barriers for first-time buyers

Inflation and interest rates: While inflation has cooled from its peak, it’s still above the Federal Reserve’s target and has seen recent gains. This keeps mortgage rates elevated and erodes purchasing power, making homes less affordable for many.

Government policies & tariffs: New or proposed tariffs on building materials like lumber, steel, and imported appliances are pushing up construction costs, further slowing new home starts and passing those costs on to buyers.

Jobs report: The labor market is showing signs of cooling. Job growth is slower, wage gains are moderating, and economists are watching for any uptick in unemployment that could dampen housing demand.

Consumer concern: Surveys show consumer confidence is fragile. High housing costs, inflation trajectory, and fears of a possible recession are making buyers more cautious and sellers more motivated to negotiate.

General economic conditions: The U.S. economy is in a “soft landing” phase—growing, but not booming. This uncertainty means buyers, sellers, and investors are all acting with more caution, contributing to slower sales and more balanced market conditions.

In brief: Even as the housing market inches toward balance, big-picture issues—from inflation and tariffs to jobs and politics—are fueling both optimism and anxiety.

What This Means (In Plain English)

For buyers:

You finally have more options and a little leverage. Don’t expect fire-sale prices, but you can negotiate, especially if you’re flexible on location or timing.

For sellers:

You need to be realistic. The days of bidding wars are fading fast in most cases. Test the market, present effectively, price right, offer incentives, and be ready for your home to sit a longer than it would have in 2021.

For renters:

Renters are increasing in number. With high ownership costs, 35% of consumers now prefer renting. But apartment supply is shrinking, likely driving rent increases, which are expected to climb by 2.8% for single-family rentals and 1.6% for multifamily units this year acc. to Barron's. And there’s even greater rent pressure further ahead. Rental cost pressures are expected to intensify through 2026–2028 as construction lags.

This market isn’t likely to shock anyone during the coming six months. But the big issues like affordability, supply and investor activity aren’t going up in steam anytime soon and these pressures will eventually lead to more severe market upheaval if not diffused.

Bottom Line:

The biggest myth is that housing prices “always go up.” Right now, they’re going up slowly, if at all, and buyers have more power than they’ve had in years. But the force exerted by high costs, tight supply, and generational divides is widening market fissures.

If you’re thinking about making a move, timing is key and knowledge is your edge. Got questions, want a deep dive on your region, or need help reading the tea leaves? Hit reply or drop a comment.

Until next time, keep your eye on what really matters—not just the clickbait.

📬 Want my weekly breakdown of what’s selling, what’s sitting, and where leverage is shifting?

Subscribe free—or get in-depth analysis at Market Update at realestateinthedistrict.com. And contact me for a consult built around your timeline.