The Double Bind: How Medical Debt and Safety Net Cuts Crush Homeownership Hopes

Why cuts to Medicaid and SNAP paired with credit reporting of medical debt will lock millions out of homeownership.

Part II: ⛓️ The Double Bind That Will Choke The Housing Market

Section: Market Decoder

Author: Susan Isaacs, Washington DC Real Estate Strategist

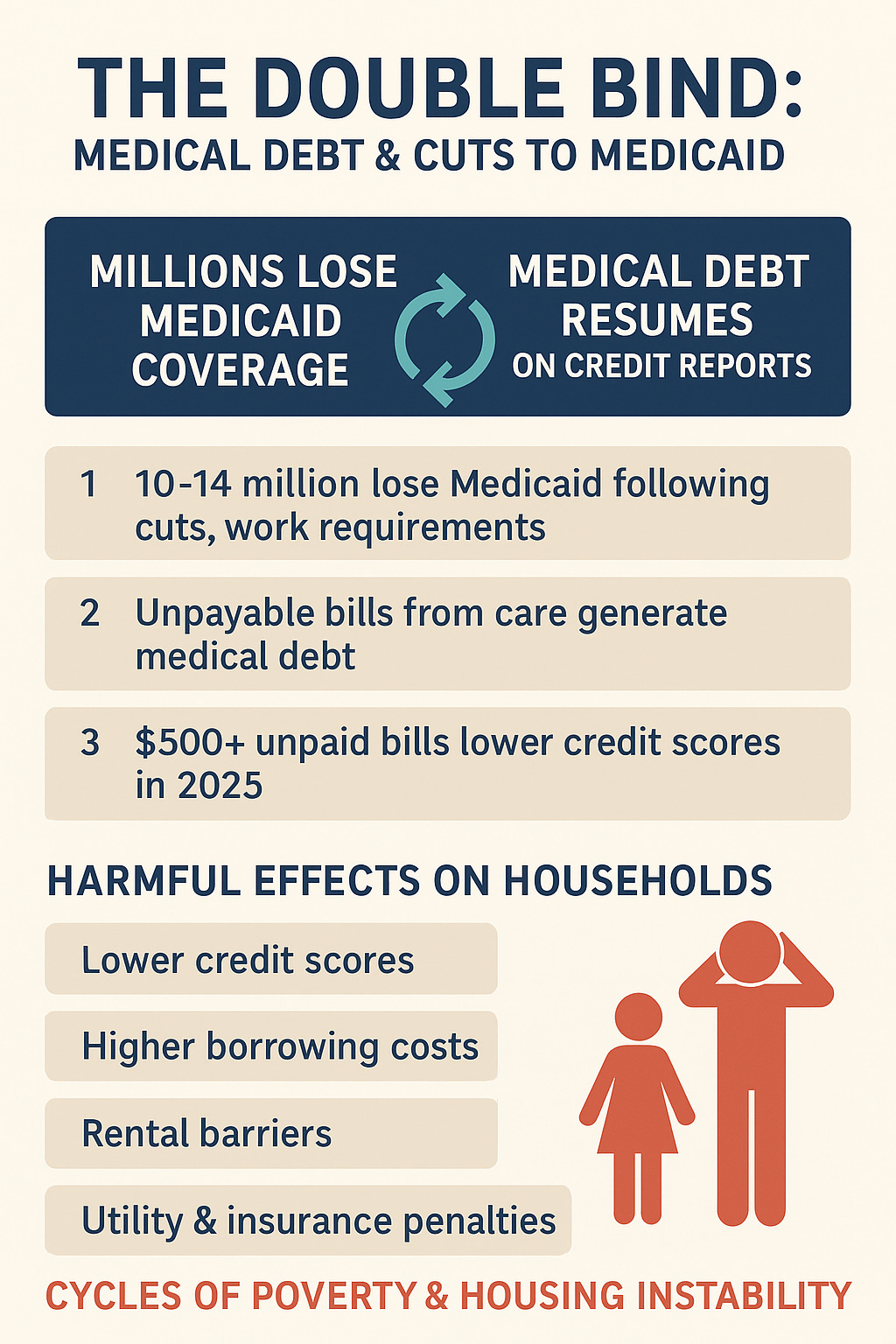

What happens when a government slashes Medicaid and SNAP, then makes medical debt visible on credit reports again?

We get a perfect storm for financial devastation—and housing will be a casualty.

In this post, I break down how millions of Americans are about to face a double financial blow; one that will suppress credit scores, increase evictions, and cut off paths to homeownership.

🧾 🪤 The Double Bind Policy Trap

The Trump administration is laying a policy trap for 80% of Americans in order to enrich the top 20%.

The “One Big Beautiful Bill Act” passed with sweeping cuts to social safety nets that will kill homeownership options on impact, and the executive order that takes the bill’s damage from moderate to catastrophic.

Damaging Social Net Cuts

Medicaid will see eligibility tightened and federal funding cut by $1 trillion from 2025 through 2034.

Medicaid will impose work and reporting requirements expected to cost millions coverage

Medicaid will also limit eligibility based on home equity value, even if recipients do not qualify for a second mortgage or HELOC

SNAP, the Supplemental Nutrition Assistance Program, faces $30 billion in cuts, with work requirements expanded and eligibility thresholds lowered. According to the Center on Budget and Policy Priorities, these changes are projected to leave over 15 million people at risk of losing health or food coverage by 2026 (CBPP, 2025).

☠️💊📉💳 The Catastrophic Executive Order

Earlier this year, the Trump administration issued an executive order reversing the Consumer Financial Protection Bureau’s (CFPB) 2022 rule that barred medical debt from appearing on consumer credit reports. The CFPB’s earlier rule was based on data showing that medical debt, unlike other forms of debt, was often incurred involuntarily and was a poor predictor of credit risk (CFPB, 2022). With the reversal, an estimated $88 billion in existing medical debt is again visible to lenders, landlords, and insurers (KFF Health News, 2024).

🏛️⛓️ The Double Bind: “One Big Beautiful Bill Act” not only costs millions of Americans food assistance and health coverage and raises household indebtedness, it blocks options for relief.

By damaging credit, the medical debt executive order prevents access to home equity, triggers higher interest rates on credit cards, and raises costs for necessary services such as home and auto insurance.

Combined, the two trap millions of Americans between two irreconcilable demands:

Pay for basic necessities and fall deeper into debt and credit crisis;

Or go without food, health care—even a place to live—to protect a credit rating rigged against them.

All to fund tax cuts and opportunity for the privileged top 20%.

🪓 Breaking Down The Risk

It’s not just the poorest Americans who are exposed—it’s the middle class, too. The double blow of safety net cuts and the reappearance of medical debt on credit reports threatens anyone who relies on insurance that doesn’t cover enough, lives in a household with a medical emergency, or simply can’t absorb an unexpected bill.

✂️📄 Medical Debt And Medicaid Cuts

Medical debt is a uniquely American problem, and it cuts across class lines. Debt makes up about 30% of a FICO credit score, and historically, medical bills have been the leading source of unpaid bills on credit reports. A medical emergency can happen to anyone, at any time. For instance, during the COVID-19 pandemic, medical debt accounted for 58% of all consumer debt appearing on credit reports—far outpacing credit cards, utilities, or collections from other sources. This is largely due to the sky-high cost of U.S. health care, paired with insurance policies that often carry high deductibles, copays, or coverage gaps, leaving even insured people exposed to crushing bills (Cornell ILR, 2024.

The numbers are staggering:

15 million Americans currently have medical bills on their credit reports, totaling roughly $49 billion in debt.

About 14 million people—6% of U.S. adults—owe over $1,000 in medical debt.

3 million people (1% of adults) owe more than $10,000 (Cornell ILR, 2024.

That burden isn’t just concentrated among those with no insurance or low incomes. Middle-class families with private insurance are routinely exposed when their deductibles reset, when a family member needs surgery, or when an illness requires out-of-network care. A single hospital stay can mean thousands of dollars out-of-pocket, and even a minor billing dispute can spiral into collections if not resolved quickly.

🏛️ Medicaid Eligibility Requirements

The bill includes Medicaid work requirements, which are expected to end coverage for millions of enrollees who do not meet new employment or reporting standards.

In the 40 states and Washington DC, where Medicaid was expanded under the Affordable Care Act, some enrollees will have to regularly file paperwork proving that they are working, volunteering, or attending school at least 80 hours a month, or that they qualify for an exemption, such as caring for a young child. The new requirement will start as early as January 2027.

🔍 To be clear, most working-age Medicaid enrollees who don't receive disability benefits already work or are looking for work, or are unable to do so because they have a disability, attend school, or care for a family member, according to KFF, a health information nonprofit.

🏛️🪤 And state’s experiments with work requirements have been riddled with administrative snafus, such as eligible enrollees' losing coverage because of paperwork problems, and budget overruns. For example, Georgia's work requirement has cost the state more than $90M, with just $26M of that sum spent on actual health benefits, per the Georgia Budget & Policy Institute, a nonpartisan research organization (NPR, 2025.

✂️📄 SNAP Cuts And Eligibility Red Tape

SNAP cuts and stricter eligibility and reporting requirements can negatively impact recipients and lead to housing insecurity in several ways:

While SNAP benefits are primarily intended for food, they can indirectly impact housing stability. SNAP's "excess shelter deduction" allows recipients to deduct a portion of their housing expenses from their income when determining their benefit amount, potentially increasing their food assistance and freeing up more resources for housing. Additionally, SNAP can help households facing financial shocks avoid resorting to costly borrowing to pay bills, thus preventing a cascade of negative financial consequences, including missing housing payments.

Reduced ability to afford food and other essentials: SNAP cuts mean households with low incomes have less money for groceries, which can force them to choose between buying enough food and paying for other essential needs like housing. Reduced SNAP benefits have been shown to increase food insecurity.

Increased financial hardship and strain: When SNAP benefits are reduced or eligibility is restricted, families experience increased financial strain. This can make it harder to afford rent and other housing costs, potentially leading to instability and even homelessness.

Expansion of work requirements: Proposed policies expanding SNAP work requirements could cut off millions of individuals, including parents and older adults, from receiving SNAP benefits. These requirements have been found to be ineffective in increasing employment and primarily lead to people losing the food assistance they need. Losing SNAP benefits can put entire households at risk of hunger, including children and individuals with disabilities.

Increased administrative burden and complexity: Proposed expansions of paperwork and reporting requirements make it more difficult for recipients to navigate the SNAP system, increasing the risk of errors and potential benefit termination. This can create additional stress and insecurity for vulnerable populations.

Indirect impact on other assistance programs: SNAP eligibility and income thresholds can be linked to eligibility for other programs, including health insurance. Changes to SNAP can affect access to other vital resources, exacerbating financial instability and vulnerability.

SNAP cuts and stricter eligibility rules reduce the financial resources available to low-income individuals and families, making it harder for already-challenged populations to afford basic necessities like food and housing. This can lead to increased food insecurity, financial hardship, and a heightened risk of housing instability.

Housing instability among SNAP recipients impacts the economy and housing for everyone, not just those receiving assistance. Economic impact results from diminished consumer spending, locally and nationally. Job instability and lower productivity lead to a less reliable workforce, impacting economic output across sectors. Housing instability is linked to physical and mental health issues that hike healthcare expenditures for individuals and the community. Lower homeowership rates and foreclosures decrease property values and tax revenue, straining municipal budgets and potentially leading to cuts in essential services.

Housing instability can erode communities, disrupt social networks, and negatively impact children's educational outcomes and future economic potential. Cuts to SNAP create a ripple effect that weakens the economy and exacerbates housing affordability challenges for a wider population.

Sources:

🏠⚠️ How This Undermines Housing

Medical debt is a credit score killer. Even a small unpaid bill can drop a FICO score by 50-100 points (Equifax, 2024). Fannie Mae and Freddie Mac both require minimum credit scores (often 620+), and medical debt can push would-be homeowners below that line. Deals fall apart at the last minute during underwriting when new medical collections pop up on credit reports.

Lower scores mean limited mortgage loan options, higher mortgage interest rates, mortgage loan denials and ineligibility for second mortgages and HELOCs. Even those home sellers not directly impacted by medical debt will be indirectly affected by a shrinking pool of qualified buyers, especially first-time homebuyers. This comes as the real estate market is already beleaguered by unaffordable home prices, high mortgage interest rates, and concerns over the economy.

For renters, the consequences include lease denials, potentially higher security deposits, or being forced into substandard housing. Property managers often use strict thresholds: a single collection account, especially medical, can trigger a denial (National Multifamily Housing Council, 2024).

⏳💥 Long-Term Consequences

This double bind creates a vicious cycle. Damaged credit from medical debt limits access to decent housing, which in turn increases housing instability and health risks—a feedback loop. Families who lose access to Medicaid or SNAP are more likely to incur new debts, deepening their financial precarity.

Long-term, the loss of social mobility is profound. Homeownership is the primary way American families build wealth. When credit scores are suppressed and down payment savings are eaten up by medical bills, the racial and generational wealth gap widens. Data already show that Black and Latino families have homeownership rates 20–30 points lower than white families (Pew Research Center, 2024), a gap that is set to grow under these policies.

In short: When the safety net frays and medical debt returns to credit reports, housing stability is one of the first casualties, and the American dream of homeownership slips even further out of reach for millions.

Additional Sources:

📍Continue the Series:

➡️ You’re reading: Part II: The Double Bind

➡️ Read: Part I: The Tax Bill and Housing: Who Gets Left Behind? →

➡️ Upcoming: Part III: What Home Buyers Need Now: The $15k Credit Congress Ignored